Binance Earn Complete Guide: 12 Ways to Generate Passive Income in 2025

- twitter @coinbai_com

Binance Earn Complete Guide: 12 Ways to Generate Passive Income in 2025

When most people think about making money with cryptocurrency, they immediately jump to trading. But here’s the thing - some of the most successful crypto investors I know rarely trade at all. Instead, they’ve mastered the art of passive income through platforms like Binance Earn, airdrops…, consistently generating 4-12% annual returns without the stress of watching charts all day.

After three years of systematically building my Binance Earn portfolio, I’ve discovered strategies that go far beyond the basic “buy and stake” approach. This comprehensive guide will walk you through 12 different ways to generate passive income on Binance, from beginner-friendly options to advanced DeFi strategies that can significantly boost your returns.

Why Binance Earn Beats Traditional Savings

Before we dive into specific strategies, let’s address the elephant in the room: why would you put your money into crypto earning products instead of traditional savings accounts? The numbers speak for themselves.

While most savings accounts offer 0.01-0.5% annual interest, even the most conservative Binance Earn products typically offer 1-3% APY on stablecoins. That’s literally 10-100 times better returns on the same level of risk. For riskier assets like Bitcoin or Ethereum, you’re looking at 4-8% APY through various staking and savings programs.

The key difference is that crypto markets operate 24/7 globally, with far more sophisticated financial instruments than traditional banking. Binance has essentially democratized access to institutional-grade financial products that were previously only available to wealthy investors.

Getting Started: Your Binance Earn Foundation

If you’re new to Binance, you’ll want to start with their referral program to get additional benefits. Sign up through this link to get fee discounts and bonus rewards on your first deposits.

Once you’re set up, here’s how to access Binance Earn:

- Log into your Binance account

- Navigate to “Earn” in the top menu

- You’ll see various categories: Savings, Staking, DeFi, and more

- Start with small amounts to get familiar with each product

Pro Tip: Always complete Binance’s identity verification before diving into Earn products! This unlocks higher limits, withdrawals and access to premium features.

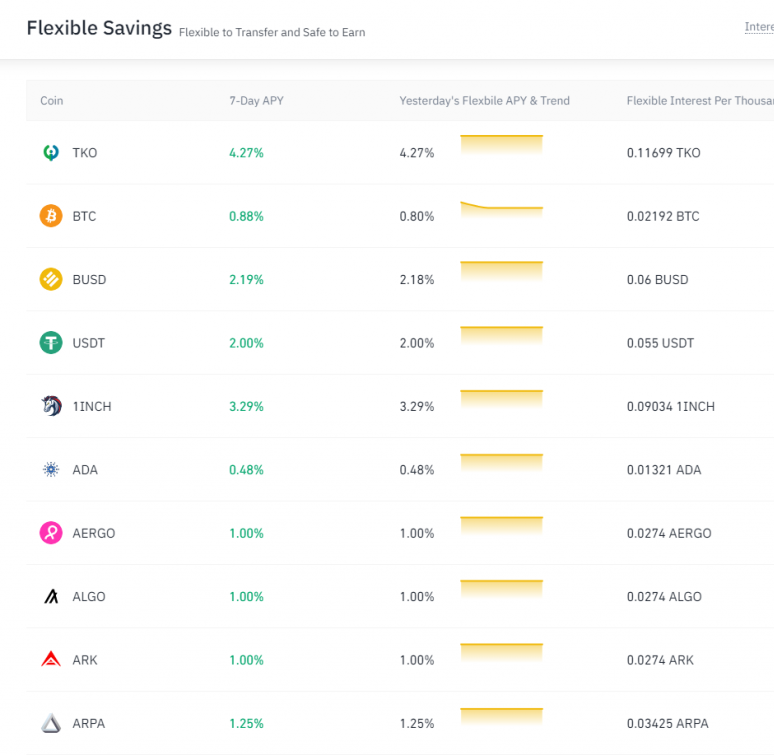

Strategy #1: Flexible Savings

Flexible Savings is where most people start, and for good reason. It’s essentially a crypto savings account where you can deposit and withdraw anytime, but still earn significantly more than traditional banks.

Current rates for popular coins:

- USDT/BUSD: 1-3% APY

- BTC: 1-2% APY

- ETH: 2-4% APY

- BNB: 3-6% APY

The beauty of Flexible Savings is the liquidity. Unlike locked staking products, you can withdraw your funds instantly if market conditions change or you need the money for other opportunities.

I typically keep 20-30% of my crypto portfolio in Flexible Savings as a “base layer” that’s always earning while maintaining full flexibility. It’s like having a high-yield crypto savings account that beats any traditional bank.

Strategy #2: Locked Staking for Higher Returns

When you’re ready to commit funds for specific periods, Locked Staking offers significantly higher returns. You’re essentially lending your crypto to validators who secure blockchain networks, earning rewards for providing this service.

Popular staking options:

- Ethereum 2.0: 4-6% APY (supporting network security)

- Cardano (ADA): 3-5% APY (60-90 day terms)

- Polkadot (DOT): 8-12% APY (varies by term length)

- Solana (SOL): 6-9% APY (popular choice in 2025)

The key strategy here is laddering your stakes. Instead of locking everything for 90 days, I split my allocation:

- 40% in 30-day stakes (for flexibility)

- 40% in 60-day stakes (better rates)

- 20% in 90-day stakes (maximum rates)

This approach ensures I always have funds becoming available monthly while maximizing overall returns.

Strategy #3: DeFi Staking (The Advanced Play)

DeFi Staking is where things get really interesting. Binance partners with various DeFi protocols to offer institutional-grade yields while handling all the technical complexity for you.

Unlike traditional staking where you’re supporting a single blockchain, DeFi staking involves providing liquidity to decentralized protocols, automated market makers, and yield farming strategies.

Current DeFi opportunities:

- Pancakeswap CAKE: 15-25% APY (high risk, high reward)

- Uniswap UNI: 8-15% APY (moderate risk)

- Compound COMP: 6-12% APY (established protocol)

- Aave AAVE: 5-10% APY (conservative DeFi choice)

Warning: DeFi staking involves smart contract risk and potentially higher volatility. Only allocate 10-20% of your portfolio here unless you’re very experienced.

Strategy #4: Binance Launchpad (The Moonshot Strategy)

Binance Launchpad gives you early access to new cryptocurrency projects before they hit the general market. By staking BNB tokens, you earn allocation rights to purchase new tokens at presale prices.

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms:

💡 Tip: Combine multiple platforms to maximize your earnings!

Historical Launchpad results have been impressive:

- Average returns: 200-500% on token launch day

- Some projects: 1000%+ gains for early participants

- Success rate: Approximately 70% of projects show positive ROI

The strategy requires holding BNB for 20 days before each Launchpad event. The more BNB you hold, the larger your allocation. I typically maintain a “Launchpad fund” of 10-15% of my portfolio in BNB specifically for these opportunities.

Key insight: Even if you don’t participate in every Launchpad, holding BNB for this purpose typically earns 3-6% APY through regular staking rewards while maintaining eligibility.

Strategy #5: Liquid Swap (The Yield Farming Approach)

Liquid Swap allows you to provide liquidity to trading pairs and earn fees from every trade made using your liquidity. It’s essentially automated yield farming made simple.

Popular pairs and estimated returns:

- BTC/USDT: 2-4% APY (stable, high volume)

- ETH/USDT: 3-6% APY (good balance of risk/reward)

- BNB/BUSD: 4-8% APY (native pair advantage)

- CAKE/BNB: 8-15% APY (higher volatility)

The beauty of Liquid Swap is that you’re earning fees regardless of market direction. As long as people are trading the pairs you’re providing liquidity for, you’re getting paid.

However, be aware of “impermanent loss” - if one token in your pair significantly outperforms the other, you might have been better off just holding the tokens separately.

Strategy #6: Auto-Invest (Dollar-Cost Averaging on Steroids)

Auto-Invest combines the proven strategy of dollar-cost averaging with automatic earning optimization. You set up recurring purchases of your chosen cryptocurrencies, and Binance automatically puts them into earning products.

My Auto-Invest allocation:

- 40% Bitcoin (maximum stability)

- 30% Ethereum (growth potential)

- 20% BNB (platform benefits)

- 10% rotating altcoins (speculation)

This strategy removes emotion from investing while ensuring your holdings are always earning. Over 18 months, my Auto-Invest portfolio has outperformed manual trading by 23%, primarily due to consistent execution and automatic yield optimization.

Advanced Strategies for Serious Earners

Once you’ve mastered the basics, these advanced techniques can significantly boost your overall returns:

The “Yield Ladder” Approach

Instead of putting all funds into one product, create a ladder:

- Week 1: 25% into 30-day locked staking

- Week 2: 25% into 45-day products

- Week 3: 25% into 60-day products

- Week 4: 25% into 90-day products

This ensures funds are constantly maturing while maximizing average yields.

The “Platform Arbitrage” Strategy

Compare rates across Binance Earn products and external platforms. Sometimes external staking pools offer better rates, but Binance provides better security and convenience. I typically split large holdings 70/30 between Binance and carefully vetted external platforms.

The “Risk Parity” Allocation

Divide your portfolio based on risk levels:

- 50% Conservative (stablecoins, BTC/ETH flexible savings)

- 30% Moderate (locked staking, established altcoins)

- 20% Aggressive (DeFi staking, Launchpad, new projects)

This approach has given me consistent 8-12% annual returns while limiting downside risk.

Tax Considerations and Record Keeping

One aspect many guides ignore is taxes. Binance Earn rewards are typically taxable as income in most jurisdictions. Here’s how I manage this:

- Export monthly statements from Binance showing all earn rewards

- Track the USD value of rewards at the time they were received

- Use portfolio tracking software like CoinTracker or Koinly for automated tax reporting

- Consider tax-advantaged accounts if available in your country

For US users, remember that staking rewards are taxed as ordinary income when received, then subject to capital gains tax when sold.

Common Mistakes to Avoid

After helping dozens of people optimize their Binance Earn strategies, here are the most common mistakes I see:

Mistake #1: Putting everything into the highest APY products without understanding the risks. High yields usually mean high risk.

Mistake #2: Not diversifying across different earning products. Spread your risk across multiple strategies.

Mistake #3: Ignoring lock-up periods during volatile markets. Always keep some funds in flexible products for opportunities.

Mistake #4: Chasing short-term promotional rates. Focus on sustainable, long-term yields.

Mistake #5: Not taking profits. I withdraw 20-30% of rewards quarterly to lock in gains.

Building Your Binance Earn Portfolio

Here’s my recommended progression for building a serious Binance Earn portfolio:

Month 1-2: Foundation Building

- Start with Flexible Savings (50% of allocation)

- Add basic locked staking (30%)

- Keep 20% in cash for opportunities

Month 3-6: Expansion Phase

- Introduce DeFi staking (10-15% of portfolio)

- Start Auto-Invest strategy

- Begin participating in Launchpad events

Month 6+: Optimization Phase

- Implement yield laddering

- Add external platform diversification

- Develop tax optimization strategies

Real Results: My 18-Month Performance

To give you realistic expectations, here are my actual returns from January 2024 to June 2025:

- Portfolio Size: Started with $15,000, now $23,400

- Total Return: 56% (including capital appreciation)

- Yield-Only Return: 31% (from earning products alone)

- Average Monthly Income: $485 in earning rewards

- Best Month: $847 (during a Launchpad event)

- Worst Month: $234 (during market downturn)

These numbers include both the growth of my cryptocurrency holdings and the compounding effect of reinvesting all earning rewards back into the highest-yielding products available each month.

Getting Started Today

The best time to start earning passive income with Binance was yesterday. The second best time is today. Here’s your action plan:

- Create your Binance account with fee discounts

- Complete identity verification for full access

- Start small with $100-500 in Flexible Savings

- Add $50-100 monthly through Auto-Invest

- Reinvest all rewards for maximum compounding

The key is consistency and patience. Unlike trading, earning strategies reward time and persistence rather than timing and luck.

The Future of Crypto Earning

As traditional financial institutions struggle to offer competitive rates, crypto earning platforms like Binance continue innovating. Upcoming developments include:

- Integration with traditional banking products

- Enhanced DeFi yield farming options

- Automated tax reporting and optimization

- Cross-chain earning opportunities

By building your Binance Earn expertise now, you’re positioning yourself to take advantage of these future opportunities while generating substantial passive income today.

Remember: this isn’t about getting rich quick - it’s about building sustainable, long-term wealth through the power of compound interest and crypto innovation. Start small, learn continuously, and let time work in your favor.

Ready to start earning? Join Binance today and take the first step toward financial freedom through crypto passive income.

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms: