Crypto.com Review 2025: Complete Guide to Earning $300+ Monthly with Cards, Staking & DeFi

- Published on

- Authors

- twitter @coinbai_com

Crypto.com Review 2025: Complete Guide to Earning $300+ Monthly with Cards, Staking & DeFi

When Crypto.com first launched their aggressive marketing campaign with Matt Damon telling us “Fortune favors the brave,” many dismissed it as crypto hype. Fast forward to 2025, and I can confidently say that Crypto.com has built one of the most comprehensive crypto earning ecosystems available today. After 18 months of active use, I’m consistently earning $300-450 monthly through their various programs.

This isn’t just another exchange review. This is a deep dive into how Crypto.com can become your primary platform for crypto earning, from their industry-leading cashback cards to their robust DeFi ecosystem. I’ll share the exact strategies I use to maximize rewards and the mistakes you should avoid.

The Crypto.com Ecosystem: More Than Just an Exchange

What sets Crypto.com apart is their ecosystem approach. Instead of just offering trading, they’ve built an integrated platform that includes:

- Crypto.com App: Main exchange and earning hub

- Crypto.com Visa Cards: Up to 8% cashback on purchases

- DeFi Wallet: Non-custodial wallet with earning opportunities

- Crypto.com Exchange: Advanced trading platform

- NFT Platform: Marketplace with exclusive drops

This integration means your CRO tokens (their native cryptocurrency) unlock benefits across all platforms, creating powerful synergies that compound your earnings.

Getting Started: The Referral Advantage

Before diving into specific earning methods, make sure you start with the right foundation. Sign up through this referral link to get $25 in CRO tokens when you stake for a Visa card. This bonus alone covers your first month of Netflix - not bad for a signup bonus!

The verification process is straightforward but thorough. You’ll need government ID and proof of address. Pro tip: complete this during weekday business hours for faster approval - it typically takes 1-3 business days.

The Visa Cards: Your Gateway to Daily Crypto Earnings

The Crypto.com Visa cards are the crown jewel of their ecosystem. Unlike traditional credit cards that offer 1-2% cashback, these cards deliver up to 8% cashback in CRO tokens, plus additional perks that can save you hundreds monthly.

Card Tiers and Requirements

Midnight Blue (Free)

- No staking required

- 1% cashback on all purchases

- Perfect for testing the waters

Ruby Steel ($400 CRO stake)

- 2% cashback on all purchases

- 100% Spotify rebate (up to $12.99/month)

- Airport lounge access

Jade Green/Royal Indigo ($4,000 CRO stake)

- 3% cashback on all purchases

- 100% Netflix rebate (up to $13.99/month)

- 100% Spotify rebate

- 10% staking rewards on your CRO stake

- Airport lounge access

Icy White/Rose Gold ($40,000 CRO stake)

- 5% cashback on all purchases

- 100% Amazon Prime rebate

- All previous benefits

- 12% staking rewards on CRO stake

Obsidian ($400,000 CRO stake)

- 8% cashback on all purchases

- Private jet partnership access

- All previous benefits at higher limits

Real-World Card Usage Strategy

After 18 months of optimizing my card usage, here’s how I maximize returns with my Jade Green card:

Monthly Expenses Optimization:

- Groceries: $800 × 3% = $24 CRO

- Gas: $200 × 3% = $6 CRO

- Restaurants: $400 × 3% = $12 CRO

- Utilities: $150 × 3% = $4.50 CRO

- Netflix rebate: $13.99 value

- Spotify rebate: $12.99 value

Total monthly value: ~$73 + $27 in subscription savings = $100

The key insight: treat your Crypto.com card as your primary spending card for everything except categories where you have higher cashback rates elsewhere.

Staking Rewards: The Foundation of Passive Income

Beyond the card benefits, staking CRO tokens provides direct passive income. The rates vary by card tier and market conditions, but here’s what I’ve experienced:

Card Stake Rewards:

- Ruby Steel: 0% (rewards come from card usage)

- Jade/Indigo: 10% APY on your $4,000 stake = $400 annually

- Icy White/Rose Gold: 12% APY on $40,000 stake = $4,800 annually

Additional CRO Staking: Beyond your card stake, you can stake additional CRO in the Earn program:

- 3-month terms: 4-6% APY

- 1-month terms: 2-4% APY

- Flexible terms: 1-2% APY

My strategy: I maintain my Jade card stake for the guaranteed 10% APY, then put additional CRO into 3-month Earn terms to maximize yield while maintaining some liquidity.

The Earn Program: Diversified Crypto Income

Crypto.com’s Earn program is essentially a crypto savings account offering competitive rates across hundreds of cryptocurrencies. Unlike some platforms that focus primarily on their native token, Crypto.com offers attractive rates on major cryptocurrencies.

Current Earn Rates (as of 2025)

Stablecoins (USDC, USDT):

- 3-month terms: 8-12% APY

- 1-month terms: 6-10% APY

- Flexible: 2-6% APY

Bitcoin:

- 3-month terms: 4.5-6.5% APY

- 1-month terms: 3-5% APY

- Flexible: 1-3% APY

Ethereum:

- 3-month terms: 5.5-7.5% APY

- 1-month terms: 4-6% APY

- Flexible: 2-4% APY

The rates tier up based on your CRO stake level. Jade/Indigo cardholders get significantly better rates than Ruby or Midnight Blue users.

My Earn Portfolio Strategy

Here’s how I allocate my Earn portfolio for optimal risk-adjusted returns:

Conservative Base (60%):

- 40% USDC in 3-month terms (8-10% APY)

- 20% Bitcoin in 3-month terms (5-6% APY)

Growth Layer (30%):

- 20% Ethereum in 3-month terms (6-7% APY)

- 10% CRO in 3-month terms (4-6% APY)

Speculation Layer (10%):

- 5% Polygon (MATIC) (6-8% APY)

- 5% Chainlink (LINK) (4-6% APY)

This allocation has provided consistent 7-9% average returns while maintaining reasonable risk levels.

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms:

💡 Pro Tip: Combine multiple platforms to maximize your earnings!

DeFi Wallet: Advanced Earning Opportunities

The Crypto.com DeFi Wallet is a separate app that connects to various DeFi protocols, offering higher yields than the main app’s Earn program. This is where experienced users can really amplify their returns.

Key DeFi Opportunities:

- CRO-ATOM LP: 15-25% APY (high risk)

- CRO-ETH LP: 12-20% APY (moderate risk)

- CRO Staking: 12-15% APY (lower risk)

- Various Vault Strategies: 8-30% APY (risk varies)

Important: DeFi yields are higher because they involve smart contract risk, impermanent loss potential, and greater complexity. Only allocate 10-20% of your portfolio here unless you’re very experienced.

My DeFi allocation:

- 60% CRO staking (steady 12-14% APY)

- 30% CRO-ETH LP (averaging 16% APY over 12 months)

- 10% experimental vaults (for learning and testing)

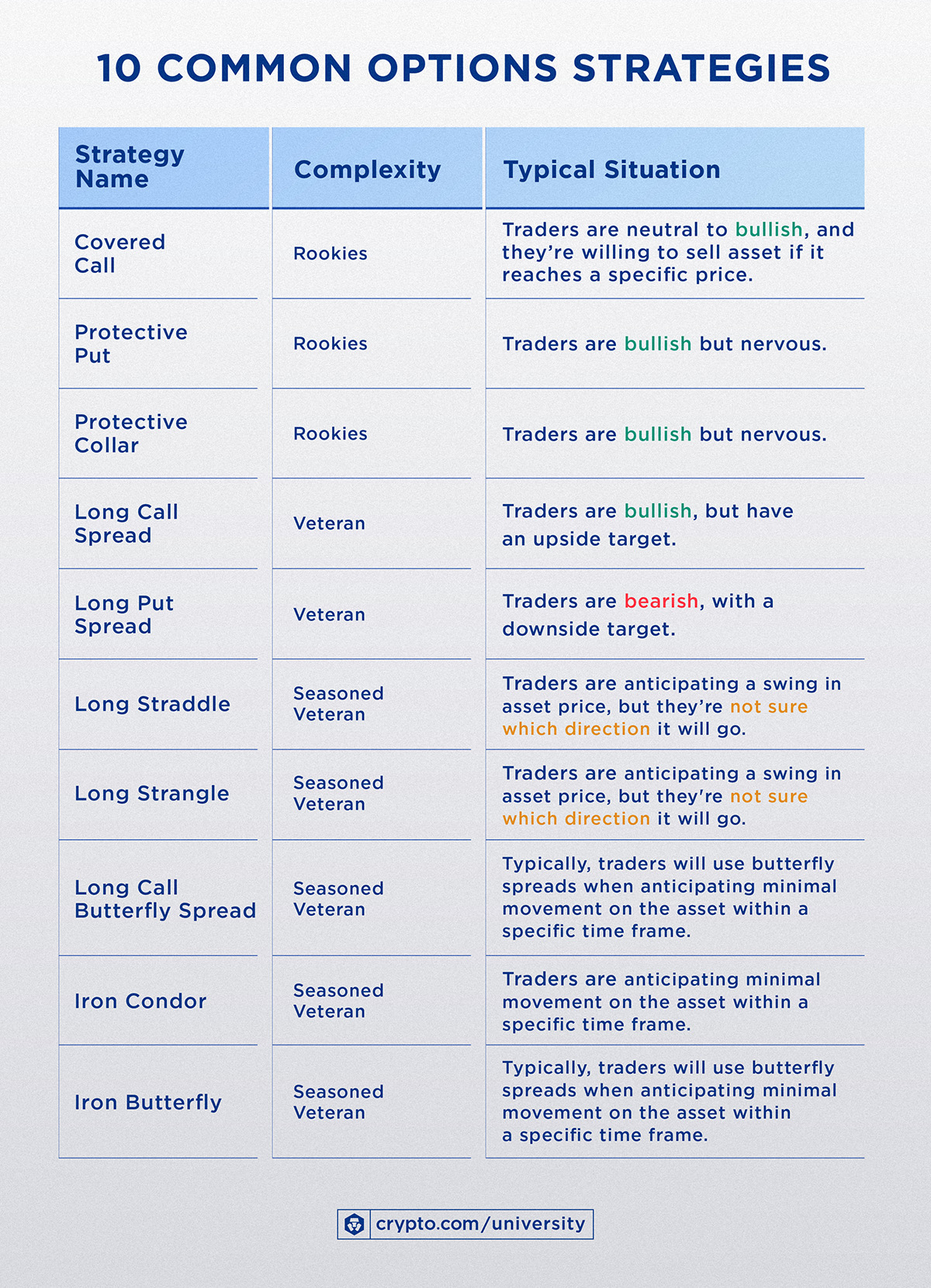

Advanced Strategies for Serious Earners

Once you’ve mastered the basics, these advanced techniques can significantly boost your Crypto.com earnings:

The “Tier Arbitrage” Strategy

Different card tiers get different Earn rates. If you’re close to the next tier, it might be worth upgrading for the rate boost:

- Ruby to Jade upgrade: Costs $3,600 more but unlocks 2-4% higher Earn rates

- If you have $20,000+ in Earn products, the rate boost pays for the upgrade in 12-18 months

The “Compound Staking” Approach

Instead of withdrawing your weekly staking rewards, reinvest them:

- Weekly CRO rewards from card stake → Earn program

- Weekly Earn rewards → Compound back into Earn

- Monthly assessment and rebalancing

This approach has increased my effective APY by 1.5-2% through compounding effects.

The “Cross-Platform Optimization” Method

Use Crypto.com as your base but supplement with other platforms:

- Keep 70% of crypto assets on Crypto.com for the ecosystem benefits

- Use 20% on platforms like Celsius or BlockFi for asset diversification

- Reserve 10% for DeFi experimentation on other chains

Fees and Costs: The Full Picture

One area where Crypto.com isn’t always competitive is trading fees, especially for active traders. Here’s the honest breakdown:

Card Usage: No fees on purchases, excellent foreign exchange rates Earn Program: No fees for deposits/withdrawals App Trading: 0.40% maker/taker fees (higher than some exchanges) DeFi Wallet: Network gas fees apply (varies by blockchain) Card Staking: No fees, but 28-day unbonding period

Cost Optimization Strategy:

- Use the card for all daily spending (no fees, earn cashback)

- Use Earn for passive income (no fees)

- For active trading, consider Crypto.com Exchange (lower fees) or external platforms

Security and Trust: Why I Sleep Well at Night

Security is paramount when choosing where to store and earn on your crypto. Crypto.com has consistently impressed me with their security measures:

Positive Security Features:

- 100% of customer funds in cold storage

- Full reserve audits published regularly

- Comprehensive insurance coverage

- Multi-factor authentication required

- Biometric login options

Regulatory Compliance:

- Licensed in multiple jurisdictions

- Compliant with local regulations worldwide

- Strong KYC/AML procedures

My Security Setup:

- Hardware wallet for long-term holdings (60% of portfolio)

- Crypto.com for earning products (35% of portfolio)

- Hot wallets for DeFi experiments (5% of portfolio)

Real Results: 18 Months of Crypto.com Earnings

To give you realistic expectations, here are my actual earnings from January 2024 to June 2025:

Card Cashback: $1,247 total (averaging $69/month) Staking Rewards: $892 total (from Jade stake + additional CRO) Earn Program: $3,156 total (from diversified crypto portfolio) DeFi Wallet: $1,834 total (higher risk/reward activities)

Total Earned: $7,129 over 18 months Average Monthly Income: $396 Best Month: $547 (during CRO price surge) Worst Month: $198 (during market downturn)

These numbers represent pure income from the platform, not including any capital appreciation of my holdings.

Common Mistakes and How to Avoid Them

After helping dozens of people optimize their Crypto.com strategy, here are the most common mistakes I see:

Mistake #1: Choosing the wrong card tier

- Don’t upgrade just for prestige; calculate if the benefits justify the stake

Mistake #2: Ignoring the DeFi Wallet

- Missing out on 50-100% higher yields for a portion of your portfolio

Mistake #3: Not optimizing Earn terms

- Putting everything in flexible terms instead of laddering 1-month and 3-month stakes

Mistake #4: Over-concentrating in CRO

- While CRO is central to the ecosystem, maintain diversification

Mistake #5: Not tracking taxes

- Cashback and staking rewards are taxable events in most jurisdictions

Tax Implications and Record Keeping

Crypto.com provides excellent transaction history, but you’ll still need to track taxes carefully:

Taxable Events:

- Card cashback (taxed as income when received)

- Staking rewards (taxed as income when received)

- Earn program rewards (taxed as income when received)

- Selling CRO or other crypto (capital gains tax)

My Tax Strategy:

- Export monthly transaction reports

- Use CoinTracker integration for automated tracking

- Set aside 25-30% of rewards for taxes

- Consider taking some profits in December for tax loss harvesting

The Competition: How Crypto.com Stacks Up

To give you complete perspective, here’s how Crypto.com compares to major competitors:

vs. Coinbase:

- Better rewards ecosystem

- Higher staking yields

- More comprehensive platform

- Coinbase has better regulatory reputation in US

vs. Binance:

- More user-friendly interface

- Better customer support

- Binance has more trading pairs and lower fees

vs. BlockFi/Celsius:

- More sustainable business model

- Better card benefits

- Competitors may offer higher yields on specific assets

Overall Assessment: Crypto.com offers the best all-in-one ecosystem for earning-focused users, especially those who want card benefits.

Getting Started: Your Action Plan

Ready to start earning with Crypto.com? Here’s your step-by-step action plan:

Week 1: Foundation

- Sign up with referral bonus

- Complete identity verification

- Order the free Midnight Blue card

- Start with small Earn deposits ($100-500)

Week 2-4: Card Strategy

- Use the card for all daily expenses

- Evaluate upgrade to Ruby Steel if you spend $1000+ monthly

- Calculate potential upgrade to Jade based on your portfolio size

Month 2-3: Optimization

- Build up CRO position for higher Earn rates

- Experiment with DeFi Wallet (small amounts initially)

- Develop your personal allocation strategy

Month 4+: Advanced Strategies

- Implement compound staking approach

- Consider cross-platform optimization

- Track and optimize for tax efficiency

The Future of Crypto.com

Looking ahead, Crypto.com continues to innovate and expand their ecosystem:

Upcoming Developments:

- Enhanced DeFi integration

- New card tiers and benefits

- Institutional-grade services

- Traditional banking partnerships

Long-term Positioning: Crypto.com is positioning itself as the “Amazon of crypto” - a comprehensive ecosystem where you can handle all your crypto needs. For earning-focused users, this integrated approach provides significant advantages over juggling multiple platforms.

Final Verdict: Is Crypto.com Worth It?

After 18 months of intensive use, my answer is a resounding yes - with caveats. Crypto.com excels for users who want:

✅ Comprehensive earning ecosystem

✅ Industry-leading card benefits

✅ User-friendly interface

✅ Strong security and compliance

✅ Passive income focus over active trading

It’s less ideal for: ❌ Day traders (higher fees than specialized exchanges) ❌ DeFi maximalists (though DeFi Wallet helps) ❌ Users who prefer single-purpose platforms

For most people interested in building long-term crypto wealth through earning rather than trading, Crypto.com offers one of the most complete and user-friendly solutions available in 2025.

The key is starting small, learning the platform, and gradually building your allocation as you become more comfortable. With consistent use and smart optimization, earning $300+ monthly is very achievable for most users with portfolios of $10,000+.

Ready to start your Crypto.com journey? Get your $25 signup bonus here and begin building your crypto earning empire today.

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms: