Bitcoin's Price Potential and Power Law Model Explained

- twitter @coinbai_com

Bitcoin’s price potential

Bitcoin has consistently been a topic of discussion for investors, tech enthusiasts, and skeptics alike. With its wild price fluctuations and growing mainstream adoption, many are left wondering: How high can Bitcoin actually go? Predictions range from conservative to astronomical, with some experts believing Bitcoin could reach hundreds of thousands—or even millions—of dollars per coin.

Some have pointed to Bitcoin’s fixed supply—there will only ever be 21 million coins in existence—as a primary reason why it could eventually surpass the market cap of gold. If this happens, Bitcoin could theoretically hit a value of around $500,000 per coin.

There are countless factors that can influence Bitcoin’s price, far too many to cover in a single blog post. While Bitcoin often moves independently, it does occasionally follow trends in the stock market. Key factors like regulatory decisions, accessibility to the public, and overall confidence in the currency also play significant roles. Additionally, while new cryptocurrencies are constantly being created, and although most struggle to compete with Bitcoin, their presence still adds a small degree of uncertainty to the value.

Power Law Model

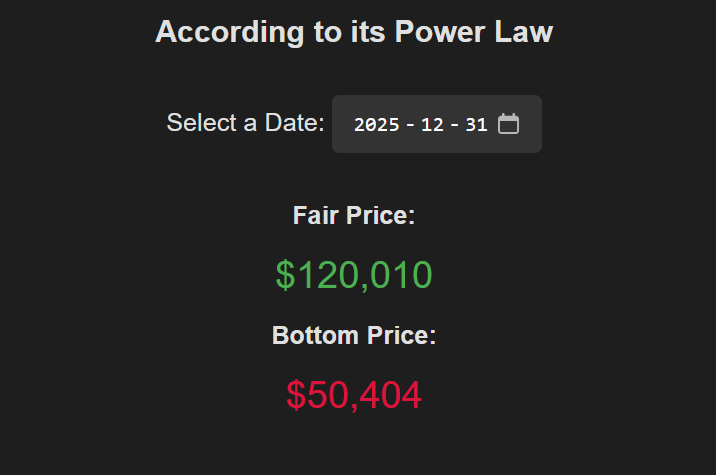

Bitcoin’s price potential is a topic of ongoing debate, and one model that has gained traction in predicting its long-term trajectory is the “Power Law Model.” The model suggests that Bitcoin’s price follows a distinct pattern that is unique compared to other assets. Introduced by Giovanni Santostasi, the Power Law Model reveals that Bitcoin’s price moves in a straight line when plotted on a log-log graph, which allows for a structured prediction of price growth over time.

At its core, the Power Law Model shows that Bitcoin’s price oscillates around a “fair price,” which is calculated based on the number of days since Bitcoin’s creation (the genesis block). According to the model, Bitcoin’s price can be either undervalued or overvalued, depending on whether it is below or above this fair price at any given time.

In general, though, the Power Law Model has held up remarkably well. Its long-term reliability gives investors some confidence that Bitcoin’s price will not only recover from dips but also continue to rise steadily over time. What the Future Holds

Looking forward, the Power Law Model offers a compelling argument for why Bitcoin could see substantial growth in the future. As Bitcoin matures and gains mainstream acceptance, the model suggests that the price will stabilize at higher levels, following a predictable path.

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms:

💡 Tip: Combine multiple platforms to maximize your earnings!

Source: Bitcoin Fair Price

Consensus

Several prominent analysts and investors have painted an extremely bullish outlook for Bitcoin. The general consensus among many Bitcoin enthusiasts is that, over time, the digital currency will continue to rise as it gains more widespread adoption. Large institutions are buying in, governments are slowly moving toward clearer regulations, and Bitcoin is starting to be viewed as a potential hedge against inflation.

Some have pointed to Bitcoin’s fixed supply—there will only ever be 21 million coins in existence—as a primary reason why it could eventually surpass the market cap of gold. If this happens, Bitcoin could theoretically hit a value of around $500,000 per coin. Others go further, suggesting that in a future where Bitcoin becomes a standard global asset, it could even approach $1 million or more. But how reliable are these models?

Not a smooth journey

However, reaching these high valuations isn’t guaranteed to be a smooth journey. Historical data shows Bitcoin experiencing significant corrections before eventually resuming its upward trend.

Despite its accuracy in the past, the Power Law Model has one known exception. In March 2020, during the onset of the global pandemic, Bitcoin briefly fell below its calculated bottom price. It’s essential to approach any prediction with a level of caution. While models are often used to project Bitcoin’s potential highs, they have their flaws. For example, some models rely on past data and assume that Bitcoin’s growth will continue at a steady rate. However, the reality is much more complex. Models like this one can be tweaked, and in fact, many have already changed their constants to reflect new data. Critics argue that these changes make the models less reliable, as they’re adjusted to fit the narrative rather than providing an objective view of future prices.

There’s also the challenge of predicting how market forces, regulations, and competition from other cryptocurrencies might affect Bitcoin’s trajectory. It’s possible that Bitcoin could hit a wall where its growth stagnates, or, conversely, it could break out in ways that no one could have foreseen.

Conclusion

Regardless of how much models may shift or change over time, Bitcoin’s future remains promising but uncertain. Many argue that Bitcoin’s fundamentals, such as decentralization and scarcity, make it a strong candidate for continued growth. However, the road ahead is not without risks.

One major risk is government intervention. Some countries have already moved to restrict or ban Bitcoin, and future regulatory crackdowns could have a significant impact on its price. Additionally, as the cryptocurrency market matures, newer technologies may arise that overshadow Bitcoin, leading to its eventual decline.

Despite these risks, Bitcoin’s decentralized nature and first-mover advantage give it a strong case for long-term viability. For now, the question remains: Will Bitcoin fulfill its potential and soar to unimaginable heights, or will external factors clip its wings before it gets there? Only time will tell.

Do you want to buy BTC?

Check out Binance exchange if you want to buy bitcoin!

Do you want the best moneymaking sites?

Check out Beermoney sites if you want an easy overview of the best money-making sites, all in one page!

🚀 Ready to Start Earning Crypto?

Join thousands of users earning cryptocurrency and cash rewards daily. Start with these top-rated platforms: