The Psychology of Money: Why We Chase Small Earnings

- twitter @coinbai_com

The Paradox of Penny Chasing

Here’s something that bothers me: I know people who’ll spend 30 minutes completing a survey for $1.50, but won’t spend 30 minutes learning a skill that could earn them $20 an hour. I know folks who religiously claim Freebitco.in faucets for 50 satoshis hourly, but avoid investing in index funds that would compound their money automatically.

Why do smart, rational people chase small, immediate rewards while ignoring larger, long-term opportunities? The answer isn’t about intelligence or laziness—it’s about psychology. Our brains are wired for immediate gratification, certainty, and progress feedback, even when it works against our long-term interests.

Understanding these psychological drivers isn’t just academic curiosity. It’s the key to using beermoney activities productively instead of falling into endless, low-value time loops that feel productive but aren’t building real wealth.

The Dopamine Feedback Loop

The Science of Small Wins Every time you complete a survey, claim a faucet, or see your balance increase by $0.47, your brain releases dopamine. That small hit of satisfaction feels good, which makes you want to repeat the activity. This is the same mechanism that makes social media, gambling, and video games addictive.

Swagbucks and similar platforms have designed their interfaces specifically to maximize these dopamine hits. Points accumulating, badges unlocking, daily streaks building—all of this triggers the reward centers in your brain.

Why This Matters The problem isn’t the dopamine itself—it’s that these small rewards can become substitutes for larger accomplishments. Your brain gets satisfied by earning $5 on Freecash, so you don’t feel motivated to pursue the freelance project that could earn $500.

The Productive Use Understanding this mechanism means you can use it strategically. Small wins from beermoney apps can build momentum for larger goals, but only if you treat them as stepping stones rather than destinations.

The Control Illusion

Certainty vs. Uncertainty Beermoney activities offer something most wealth-building strategies don’t: certainty. Complete this survey, get $2. Click this button, earn 5¢. The relationship between effort and reward is immediate and predictable.

Compare that to investing, where you might lose money in the short term. Or skill development, where months of effort might not translate to immediate income. Or starting a business, where success is far from guaranteed.

The Psychological Comfort This certainty feels safe. You can’t lose money on Cointiply faucets the way you might lose money in crypto trading. You can’t fail at survey completion the way you might fail at starting a YouTube channel.

The Hidden Cost But this comfort comes with opportunity cost. The time spent on guaranteed small earnings is time not spent on potentially larger but uncertain opportunities. The safety of small wins can become a prison that prevents real wealth building.

The Progress Bias

Visible Progress vs. Invisible Growth Beermoney apps provide constant, visible progress. You can watch your balance grow from $5.23 to $5.75 to $6.42. Numbers go up, achievements unlock, streaks build.

Learning programming might be more valuable, but the progress is invisible for months. Building an emergency fund is smart, but watching $50 sitting in a savings account doesn’t provide the same psychological satisfaction as earning $50 through completing tasks.

The Gamification Effect Many beermoney platforms gamify the earning process with levels, badges, and completion percentages. This taps into the same psychological mechanisms that make video games engaging—the sense of constant advancement and achievement.

Why Our Brains Prefer It Human brains evolved to prioritize immediate, tangible results over abstract future benefits. Seeing $0.50 appear in your account today triggers more satisfaction than knowing you’re building long-term wealth.

The Effort Justification Phenomenon

Making Small Work Feel Important Once you’ve invested time in beermoney activities, your brain starts justifying that investment by making the work feel more important than it actually is. This is called effort justification—the more effort we put into something, the more valuable we convince ourselves it is.

People who’ve spent months building up HoneyGain earnings often talk about their “$15 monthly passive income” as if it’s a significant achievement, even though $15 monthly could be earned in one hour of work at minimum wage.

The Sunk Cost Trap This psychological investment can prevent people from moving on to better opportunities. “I’ve built up my Swagbucks account for six months” becomes a reason to continue inefficient earning rather than trying new strategies.

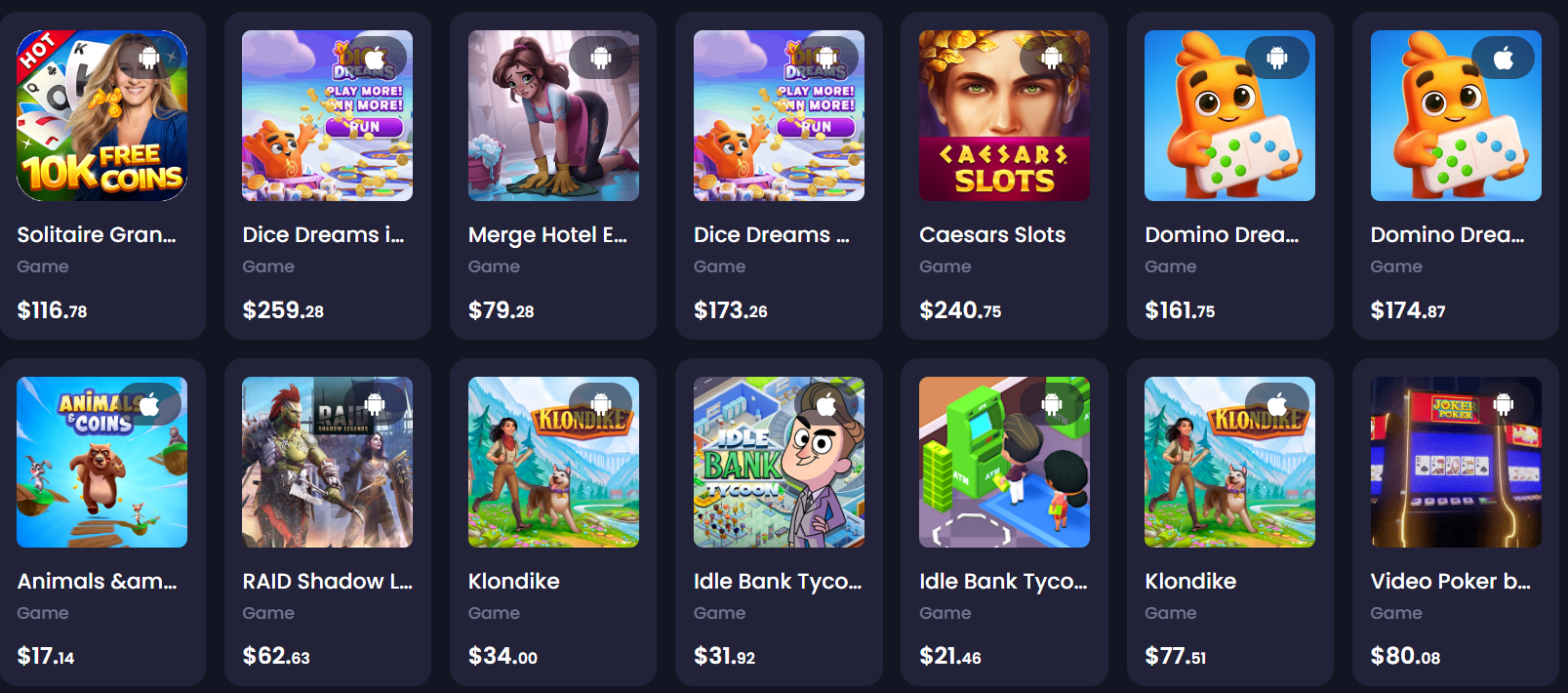

💡 Want More Money-Making Opportunities?

Discover the best money-making sites, all in one convenient location:

💡 Tip: Combine multiple platforms to maximize your earnings!

The Identity Formation Spending significant time on beermoney activities can become part of your identity. You become “someone who earns money from apps” rather than “someone building wealth” or “someone developing valuable skills.”

The False Productivity Trap

Feeling Busy vs. Being Productive Beermoney activities can create a strong sense of productivity. You’re working, earning money, being efficient with your time. The problem is that this feeling of productivity can mask the fact that you’re not actually building meaningful income or developing valuable skills.

The Opportunity Cost Blindness When you’re actively engaged in earning activities, it’s easy to ignore what you’re not doing. Thirty minutes on surveys doesn’t feel like thirty minutes not learning, not exercising, not building relationships, or not working on higher-value projects.

The Metrics Trap Beermoney activities provide clear metrics—dollars earned, tasks completed, time invested. These metrics feel objective and meaningful. But they can distract from less measurable but more important goals like skill development, relationship building, or creative pursuits.

The Social Validation Factor

Community Reinforcement Beermoney communities on Reddit, Discord, and Facebook provide social validation for earnings activities. Sharing screenshots of payments, celebrating milestones, and discussing strategies all reinforce the importance of these activities.

Relative Success In beermoney communities, earning $100 monthly can feel like significant success because it’s above average for that context. But $100 monthly is still only $1,200 annually—not exactly life-changing money for most people.

The Echo Chamber Effect Spending time in communities focused on small-scale earning can narrow your perspective about what’s possible. When everyone’s discussing how to optimize $20 monthly from faucets, it becomes harder to think about opportunities that could generate $200 monthly.

The Time Perception Distortion

Undervaluing Your Time Beermoney activities can distort your perception of time value. Spending an hour to earn $3 starts feeling normal, even though that’s terrible pay by almost any standard.

The Fractionation Effect Small amounts of time feel less valuable than they actually are. Fifteen minutes here, ten minutes there—it doesn’t feel like much. But those scattered minutes add up to hours weekly that could be invested in more valuable activities.

The Entertainment Value Justification Many people justify low-paying activities by claiming they’re “entertainment.” Watching videos on Swagbucks while earning $0.30 an hour feels reasonable if you would have watched videos anyway. But this logic can prevent you from choosing more valuable ways to spend entertainment time.

The Productive Psychology Approach

Using Small Wins Strategically Instead of avoiding beermoney activities entirely, use them as psychological tools for building momentum toward larger goals. Earn $50 monthly from Freecash, then put that money into a high-yield savings account or investment account.

Building Financial Habits Use beermoney earnings to practice financial management. Track earnings, set aside money for taxes, experiment with different savings strategies. These habits scale up when your income grows.

Learning Business Concepts Treat beermoney activities as business education. Learn about conversion rates, customer acquisition, market research, payment processing. These concepts apply to larger business opportunities.

Developing Meta-Skills Use beermoney work to develop skills that transfer to higher-value activities—time management, goal setting, performance tracking, routine building.

Breaking the Small Earnings Addiction

Set Opportunity Cost Awareness Before any beermoney activity, ask: “What else could I do with this time that might generate more value?” Sometimes the answer is still “complete surveys,” but often it’s not.

Create Earnings Caps Set maximum time or money limits for beermoney activities. For example: “I’ll earn maximum $100 monthly from apps, then focus energy elsewhere.”

Build Transition Plans Use beermoney earnings as funding for higher-value activities. Earn $200 over three months, then use it to buy a course, attend a conference, or invest in equipment for a side business.

Track Holistic Progress Measure success by net worth growth, skill development, and relationship quality—not just beermoney earnings.

The Wealth Building Mindset Shift

From Linear to Exponential Thinking Beermoney activities scale linearly—more time equals more money. Wealth building activities scale exponentially—skills, investments, and businesses can grow income without proportional time increases.

From Immediate to Compound Focus Instead of optimizing for this week’s earnings, optimize for next year’s earning potential. What skills, investments, or opportunities could generate 10x returns over time?

From Individual to System Thinking Rather than completing tasks for money, build systems that generate income. Create content, develop skills, build relationships that pay dividends over time.

From Scarcity to Abundance Mentality Small earnings can reinforce scarcity thinking—every dollar matters because dollars are hard to come by. Wealth building requires abundance thinking—focusing on increasing income potential rather than hoarding small amounts.

Using Psychology to Your Advantage

Gamify Real Wealth Building Apply the same gamification that makes beermoney addictive to wealth building activities. Track skill development, investment growth, business metrics with the same enthusiasm.

Create Immediate Feedback Loops Find ways to get quick feedback on wealth building activities. Take online courses with completion certificates, track workout progress, monitor investment account growth.

Build Achievement Systems Create personal reward systems for long-term goals. Complete a course, treat yourself to something special. Reach an investment milestone, celebrate meaningfully.

Use Social Accountability Join communities focused on wealth building, skill development, or business creation. Replace beermoney community validation with communities aligned with larger goals.

Understanding the psychology behind small earnings addiction is the first step to building real wealth. Check our money sites directory for platforms that can serve as stepping stones to larger opportunities. Remember: small earnings can be smart strategy, but only if they’re part of a bigger plan.

💡 Want More Money-Making Opportunities?

Discover the best money-making sites, all in one convenient location: